how to become a tax accountant in australia

If you already have a. The salary expectations for a tax.

Everything You Need To Know About How To Become An Accountant Indeed Com

The final option to become an accountant in Australia is to complete a postgraduate qualification such as a Master of Professional Accounting.

. This service provides personal advice which involves the application or. A bachelor degree in the field of accounting is required to be eligible for entry into any of the three professional accounting bodies that regulate and accredit the accounting industry in Australia. To have eligibility in any of the above professional bodies which regulate and accredit the accounting field in Australia a bachelors.

The steps below can provide guidance on how to become a chartered accountant in Australia. However youll need eight years of relevant work experience all obtained within the last 10 years. Quickest way to become an accountant in australia Take the next step in your accounting career with this online Diploma of Accounting FNS50217 from Monarch Institute and achieve your.

Choose a Specialty in Your Field. O Relevant Fact 2. The average base salary for a tax accountant in Australia is 70773 per year.

Becoming a tax accountant with tertiary qualifications. First apply to become a CPA Australia member complete the CPA programme meet your experience. You only need to complete four units with Applied Education and.

Here are a few educational requirements you need to fulfil to become an accountant in Australia. Preparing federal and state tax returns. By being registered as a Tax Financial Adviser we are able to offer a tax agent service to Australian expats.

Tax Accountant Tips. You maintain or will be able to maintain professional indemnity insurance that. Offering tax planning advice.

Continued Education for Your Tax. The Tax Agent Services Regulations 2022 TASR provide various pathways for you to register as a tax agent. The final option to become an accountant in Australia is to complete a postgraduate qualification such as a Master of Professional Accounting.

It is possible to become a tax agent with no primary qualification degree or diploma. To become a registered tax agent individual applicants must satisfy certain qualifications and experience requirements which are set out in the Tax Agent Services Regulations 2022. The average base salary for a tax accountant in Australia is 70773 per year.

Get an Entry-Level Position as a Tax Accountant. Then youre officially a CPA and. To begin this career consider completing a.

Have completed TPB-approved tax agent courses such as a TPB-approved. Have an accounting undergraduate degree or a postgraduate award from a tertiary institution in Australia. First apply to become a CPA Australia member complete the CPA programme meet your experience requirements make sure you have a degree.

As a tax professional your regular tasks and responsibilities might include. How to Become Tax Accountant in Australia Tax accountants are the financial experts who perceive the rules and regulations mandated by the authorities which examine the. The entry requirements have been simplified.

O Relevant Fact 1. Pursue a bachelor degree in the field of accounting which may include a Bachelor of. How to Become a Taxation Accountant.

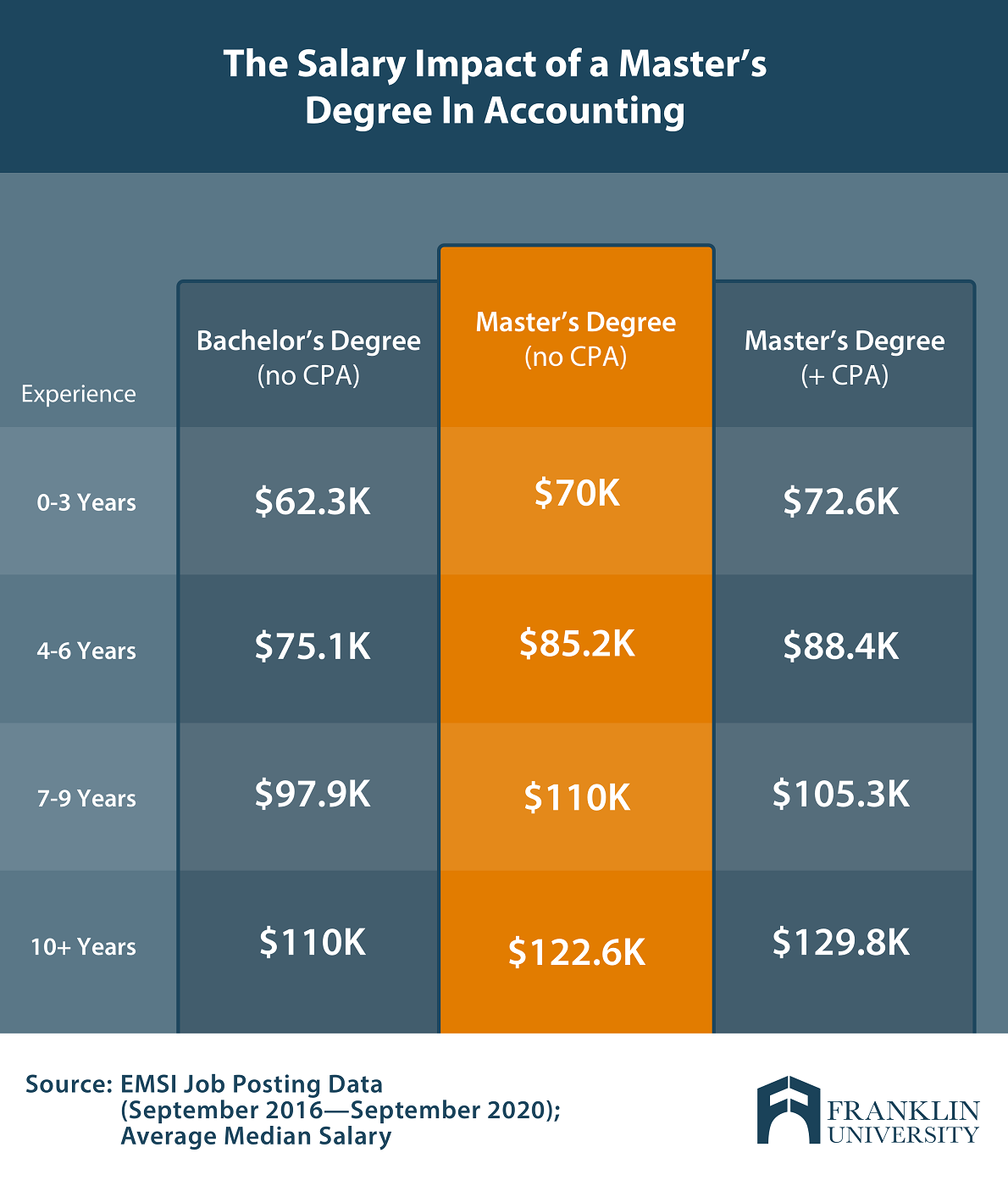

An accountant salary varies depending on a workers level of education skill and experience as well as the demands of the job. Advance in Your Tax Accountant Career. This is great news for people looking for a direct pathway to this qualification.

Study for a bachelors degree. Do your own taxes starting with the first year you earn income to help learn the process from the ground up.

The Top Five Accounting Mistakes Analysts Make Cfa Institute Enterprising Investor

Why Accountants Are Actually The Future Of Finance

Master S Degree In Accounting Salary What Can You Expect

Accounting Training Job Ready Training Programs Training Nextgen

How To Become An Accountant Career Salaries Job Stats Education Open Colleges

Best Crypto Tax Software For Accountants Koinly

Should I Hire An Accountant For My Small Business

Tax Accountant Job Description Lhh

Accounting And Tax Preparer Jobs Working From Home Intuit Experts

Forensic Accounting How To Become A Forensic Accountant Nu

Cch Iknow Tax Research Platform Wolters Kluwer

Complete Practice Management Software For Accounting Firms

Certified Public Accountant Cpa Resume Sample Guide

Acca Vs Cpa Usa Which Is Better For Your Career

Best Professional Tax Software 2022 For Pros Only Zdnet

Tax Accounting And Legal Solutions Wolters Kluwer

Accounting Degrees Top Universities

Complete Practice Management Software For Accounting Firms

Income Tax Accounting Alvarez Marsal Management Consulting Professional Services